Commercial real estate in Washington County continues to show growth across the board.

The St. George Metro area is popping up on the national radar and quickly climbing up the rankings: #2 in job growth, #11 Best Small Places For Business, 3.2% Unemployment and #7 Fastest Growing Micropolitan Areas in the U.S.

These highly publicized statistics are fueling that growth.

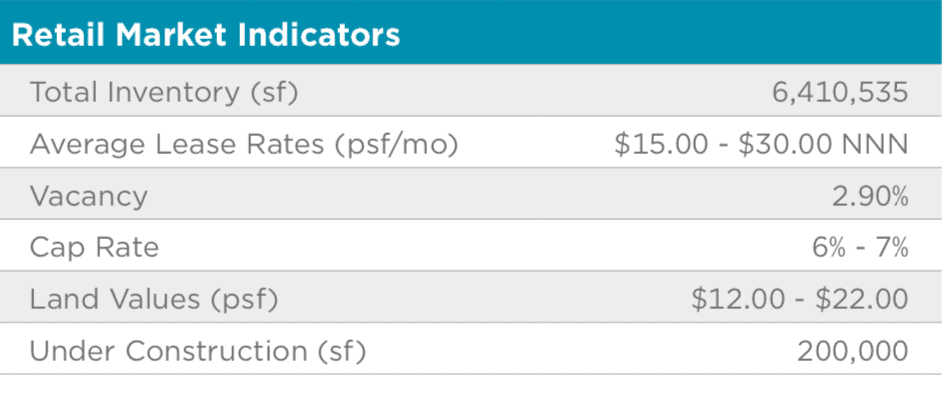

Retail was the most active sector with the addition of several grocers and restaurants, along with a significant increase in retail and highway commercial/quasi-retail land sales.

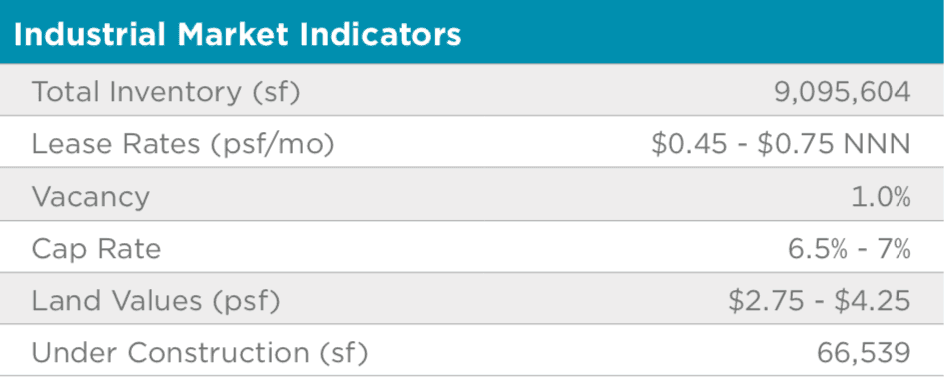

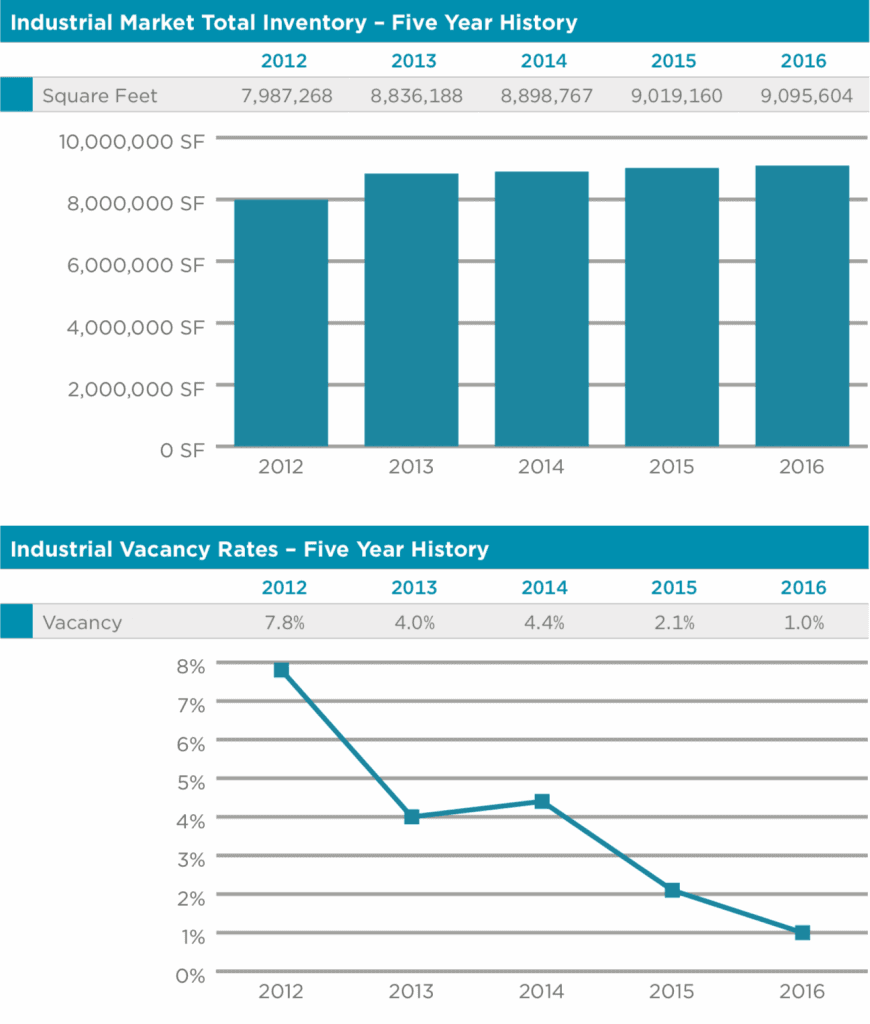

Industrial has hit a record low vacancy of 1.0%, and the office is strengthening. Demand for quality investment properties remains high. Intermountain Healthcare has begun construction on a 180,000 SF addition to the hospital.

Dixie State University recently completed a 90,000 SF student housing complex. Commercial land sales have picked up with several recent sales of larger parcels along I-15 being completed.

Residential construction also remains strong. St. George’s reputation as “One of the Best Places to Live” continues to draw visitors, residents, and companies with its unsurpassed quality of life, warm climate, and outdoor activities.

Office Market Trends

Office Market 2016 Year End Review

- Vacancy dropped to 6.7%

- Historic high office occupancy achieved

- Mean asking lease rates increased 5%

Office Market Forecast

Notable Transactions

- 1165 West Silicon Circle (12,011 sf) owner user sale

- 1492 West Silicon Way (9,950 sf) investment sale

- Social Security office vacates 7,000 sf of office space and moves into retail space

- Civil Science leases 6,339 sf at WCF Building

We expect the improving trend to accelerate in 2017 with vacancy decreasing and lease rates improving further. expected to increase by 7-10% in 2017.

Industrial Market

Industrial Market 2016 Year End Review

- Mean asking lease rates (NNN) increased to $0.55 SF, up 15% year over year

- Vacancy is at a record low of 1%

- Industrial lot sales have picked up signalling a return to new construction.

- Vacancy could bump up in Q1-Q2 of 2017

- Little new construction continues to push lease rates higher

The market showed solid improvement in the second half of the year after holding steady for the first half of 2016. Vacancy skipped down to 6.7%, which is the lowest office vacancy rate in the past nine years.

Average asking lease rates bumped up to $0.99/SF NNN, which represents a 5% increase from last year. Dixie Power has two new buildings, totaling 29,412 SF, under construction.

There is an additional 57,000 SF in the planning phase expected to go vertical in 2017.

The prolonged recovery and shrinking vacancy has caused a lack of viable spaces on the market for sale or lease. This is particularly true in the Class A sector.

This leasing grid-lock has frustrated both landlords and tenants to some degree, with some persistent vacancies from the landlord perspective and a lack of viable alternatives for tenants looking to expand or relocate.

The remaining vacant B and C spaces often have either, obsolete floor plans, location challenges, or older-building challenges, making them less desirable in the current market.

These factors will put increased upward pressure on rates and prices as buyers and tenants compete for the best spaces in the market in 2018.

Investment activity has slowed from the pace of 2015 but is still fairly active. The Washington County industrial sector dropped to a historic low vacancy of 1.0%. Lease rates are approaching 2006-2007 levels.

Costs of new construction are as high as or higher than they have ever been, limiting new construction. With the acute shortage of available space for lease or sale, offerings priced at the market are seeing significant action.

Gustave A. Larson Company moved into a new facility in the St. George Industrial Park. Hansen Landscape added another building off Washington Dam Rd. Lee’s Storage was a new entrant into Ft. Pierce Industrial Park adding over 44,000 SF on nearly 5 acres.

Holbrook Asphalt is completing a new building in Ft. Pierce Industrial Park. A new 20,000 SF asphalt batch plant is completing construction in the Fairgrounds Industrial Park.

Several smaller metal buildings under 5,000 SF are under construction off Washington Dam Road. Several major corporations are also considering projects in Washington County due to the availability of land and low electrical costs.

Industrial Market Forecast

We expect vacancy to bump up in Q1-Q2 of 2017 with new spec space coming to the market towards the end of Q2, and nearly 180,000 SF of vacancy expected to hit the market.

From a tenant vacating space in the old St. George Industrial Park. Lease rates will continue to climb to meet new construction costs on masonry and concrete tilt-up buildings.

We will witness lease rates starting to bifurcate into different rates for office vs. warehouse, like what occurred in 2005- 2007, driven by new construction.

The best investment opportunities in this sector will be to pick up underpriced industrial land parcels, smaller single tenant buildings, or a larger spec building (50,000 SF +).

We expect lot sales and new construction to continue to increase at a measured pace as the leasing market adjusts to the new normal.

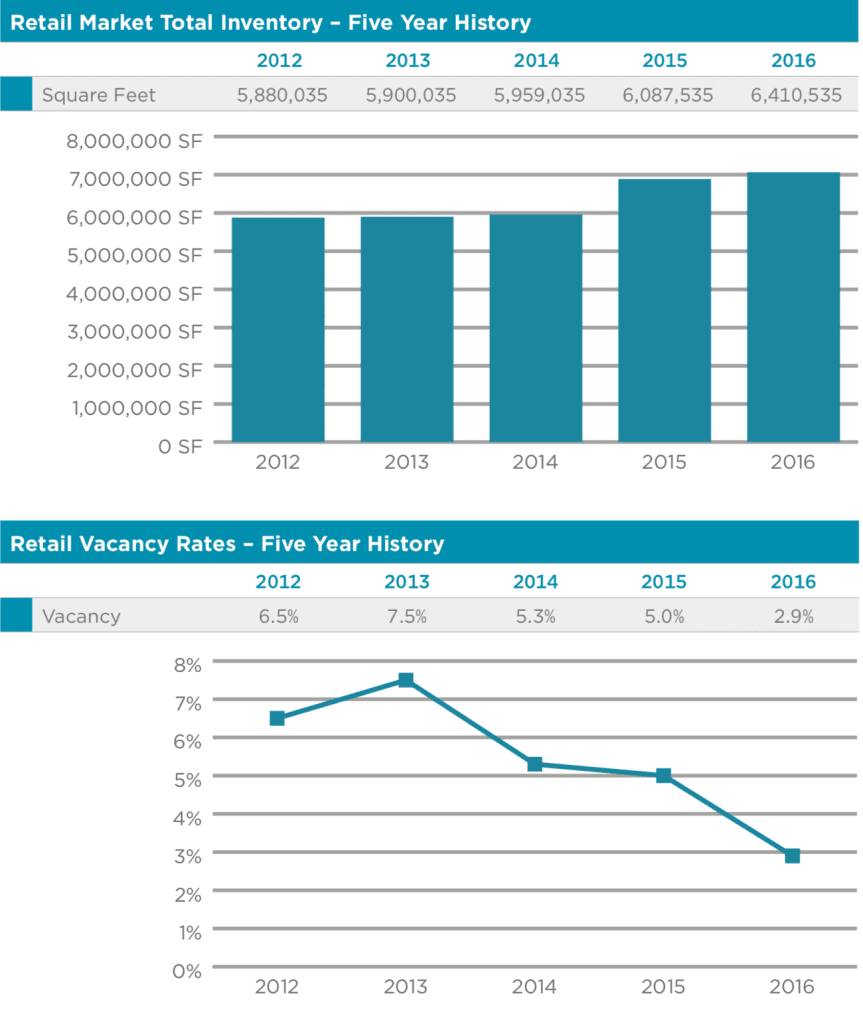

Retail Market Trends

Retail Market 2016 Year End Review

- Vacancy is down to 2.9%

- Average asking lease rates (NNN) held from year end.

- 178,000 sf of new construction space added to the market

- 200,000 sf currently under construction

- New grocery anchored centers and hotels have been the big news in retail this year

2016 has been a strong year for the retail market. Vacancy is down from 5.0% to 2.9% at year-end 2015. New buildings completed in 2016 include:

- Harmon’s in Santa Clara

- Lin’s Market in Washington Fields

- Stephen Wade’s Mercedes Benz Dealership

- Maverik convenience store/gas station on the corner of St. George Blvd. & 1000 East

- Holiday Inn Express next to the convention center opened this spring, which included an onsite restaurant Burger Theory.

- Tagg-N-Go Car Wash opened their first location in the market on Sunset Blvd. and has a second under construction on River Road.

- Dairy Queen is just completing their newest restaurant on the corner of Main Street and 1160 South.

- Smith’s is bringing their first Marketplace concept to Southern Utah. The new store will be 123,000 sq ft and is currently under construction.

Numerous restaurants, financial institutions, and neighborhood service companies are negotiating for space around these new centers, so there is a long list of new retailers that will be coming in 2017.

Starbucks and Taco Bell’s additional locations are beginning construction on Telegraph Street. Nielson RV’s new 22,000 sq ft facility, on 7 acres, is expected to be completed by the end of December 2016.

The hotel industry took over the top spot for activity in the commercial market with the completion of the Holiday Inn Express, Wyndham Wingate, Springhill Suites in Springdale, the Hyatt Place Lite, which is under construction.

The Hampton Inn, Staybridge Suites, and Springhill Suites at Green Springs are all pushing for 2017 start dates. These new hotels will undoubtedly attract other commercial users as well.

We have also seen a surge in retail/commercial land sales this year, especially along Interstate 15.

Retail Market Forecast

We expect retail to attract significant attention again this year with the completion of the grocery-anchored centers and hotels.

This will bring new tenants and interest into the St. George market.

We expect that vacancy will continue to drop and lease rates to trend upwards.

Travis Parry, SIOR, CCIM

Partner – LINX Commercial Real Estate

[email protected]

435-359-4901